Manufacturing, Not Just MoUs: PHDC Courts Egyptian Capital for LPG Safety and Value Addition

Declaring 2026 a year of action is one thing. Drawing manufacturing capital into the orbit of a $60 billion petroleum hub is another. PHDC’s engagement with an Egyptian consortium targeting fibre LPG cylinder production offers a concrete glimpse of how Ghana’s flagship energy project is beginning to take physical form.

Jomoro, Western Region, Ghana | February 9, 2026 - The Petroleum Hub Development Corporation is beginning to convert ambition into investable geometry.

In its latest engagement with foreign capital, an Egyptian-backed investment consortium led by Chemexa Petrochemical Trading, in partnership with Kaolin, has opened discussions to establish a fibre composite LPG cylinder manufacturing plant in Ghana. The proposal is modest in footprint but large in implication: a downstream-adjacent manufacturing asset anchored to the broader Petroleum Hub Development Project, and a test case for PHDC’s strategy of crowding in serious, value-chain-aligned investors as execution ramps up.

The proposed factory would produce next-generation composite gas cylinders designed to last up to 20 years, offering a safer and lighter alternative to the steel cylinders that dominate Ghana’s LPG market. The investors say the fibre cylinders are up to 50 percent lighter, fully recyclable, and engineered to record significantly fewer explosions.

For PHDC, the pitch lands at a carefully chosen moment.

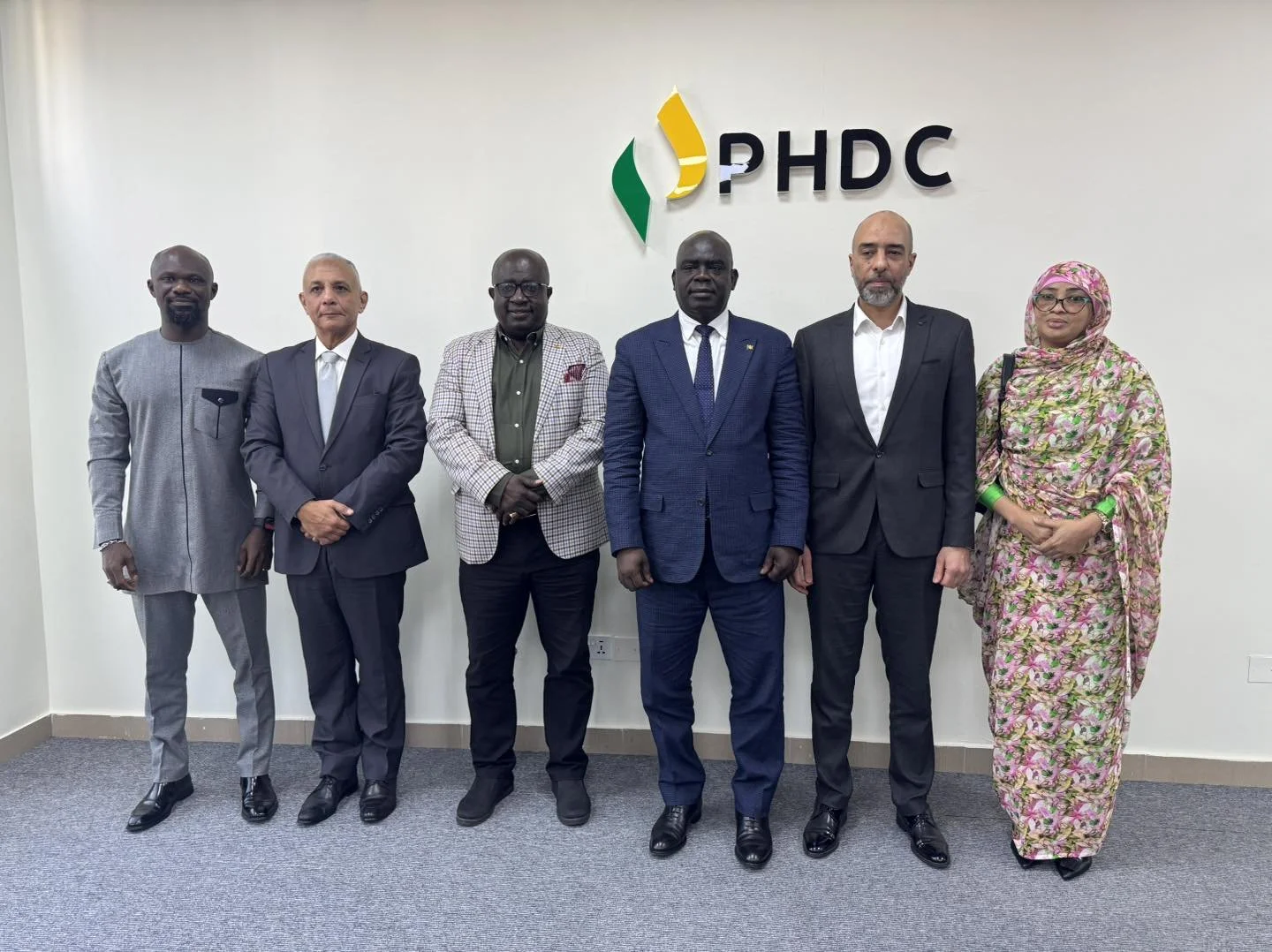

Chief Executive Officer Dr Toni Aubynn, who received the delegation, described the proposal as one with the potential to strengthen Ghana’s LPG ecosystem while improving household and industrial safety. He indicated that the Corporation would review the investment formally, situating it within PHDC’s wider mandate to build an integrated petroleum and petrochemical value chain rather than a collection of isolated assets.

Beyond the cylinder factory itself, the consortium has signalled an intention to commit approximately $200 million to projects under the Petroleum Hub Development Project, reinforcing its longer-term positioning within Ghana’s energy infrastructure build-out.

From MoUs to Manufacturing Signals

The engagement builds directly on an existing relationship. In October 2025, Chemexa Petrochemical Trading and Afdat Group of Companies signed a Memorandum of Understanding with PHDC, providing a preliminary framework for participation in the hub through the construction of storage tanks with a cumulative capacity of up to seven million cubic metres. That agreement placed the Egyptian group firmly inside PHDC’s early investor cohort.

What distinguishes the latest proposal is its tilt toward manufacturing rather than pure infrastructure.

Composite LPG cylinders are not core hub assets in the traditional refinery-petrochem-storage triad. Yet their relevance is strategic. They sit at the intersection of clean cooking policy, LPG market deepening, safety regulation, and domestic value addition, areas where Ghana’s downstream sector has long sought structural upgrades.

In that sense, the proposal mirrors PHDC’s broader thesis: that the petroleum hub must catalyse industrial spillovers, not merely host bulk processing capacity.

The Year of Action Doctrine

The timing also aligns with PHDC’s internal posture shift. At the start of 2026, Dr Aubynn publicly framed the year as a “year of action,” underscoring a unified resolve between the Board and Management to move the project decisively from planning into execution. That declaration followed sustained advocacy by PHDC leadership for integrated natural resource processing as Africa’s most credible route to economic transformation, a theme Dr Aubynn has advanced at regional trade and policy fora.

Within that context, investor conversations are no longer exploratory rituals. They are increasingly filtered through readiness, capital depth, and alignment with the hub’s phased development logic.

The Chemexa-led consortium fits that filter. Established in 2018 and led by owner and general manager Khaled Sawaby, Chemexa Petrochemical Trading has built a footprint across more than 20 countries, supplying raw materials to plastics, detergents, fertilizers, paints, and mining exploration industries, while offering specialized logistics and storage services. Its operating model is familiar with scale, compliance, and cross-border execution, attributes PHDC has quietly prioritised as it curates its investor base.

Momentum Building, Architecture Taking Shape

The engagement also sits within a wider pattern of early-stage acceleration. PHDC has now signed three substantive MoUs that collectively sketch the project’s initial architecture. These include a GH₵300 million agreement with Mannschaft to advance preparatory works, a strategic collaboration with Surbana Jurong on planning and design frameworks, and the Chemexa–Afdat storage tank agreement that anchors bulk infrastructure participation.

Together, these moves mark the transition from concept evangelism to institutional assembly.

Established under the Petroleum Hub Development Corporation Act, 2020 (Act 1053), PHDC is mandated to develop a world-class petroleum and petrochemical hub in Jomoro, Western Region. The $60 billion project envisions three refineries with combined capacity of 900,000 barrels per stream day, five petrochemical plants, storage facilities totalling at least 10 million cubic metres, and marine infrastructure to support regional import and export flows.

If realised, the hub would position Ghana as a continental energy logistics and processing node, serving West Africa and beyond while embedding domestic industry into the value chain.

The proposed composite LPG cylinder factory does not, on its own, move those volumes. But it signals something arguably more important at this stage: investor confidence that the hub is becoming a platform upon which adjacent industries can be built with commercial logic.

For PHDC, that is precisely the kind of signal a year of action is meant to produce.