Disciplined Regulation as Industrial Policy: Ghana’s NPA Makes Its Case at the Nigeria International Energy Summit

In a downstream landscape often defined by policy ambition and regulatory slippage, Ghana’s National Petroleum Authority is staking out a different proposition. Addressing the 2026 Nigeria International Energy Summit, Chief Executive Godwin Edudzi Kudzo Tameklo argued that disciplined regulation—backed by enforcement, pricing integrity, and institutional resolve—is what ultimately turns refining capacity and distribution networks into functioning markets that serve investors, operators, and consumers alike.

NIES, Nigeria | February 6, 2026 - At a summit increasingly defined by hard questions about Africa’s ability to retain value from its hydrocarbons, Ghana’s downstream regulator arrived in Abuja with a clear proposition: that discipline, not deregulation, is the missing infrastructure in Africa’s downstream markets.

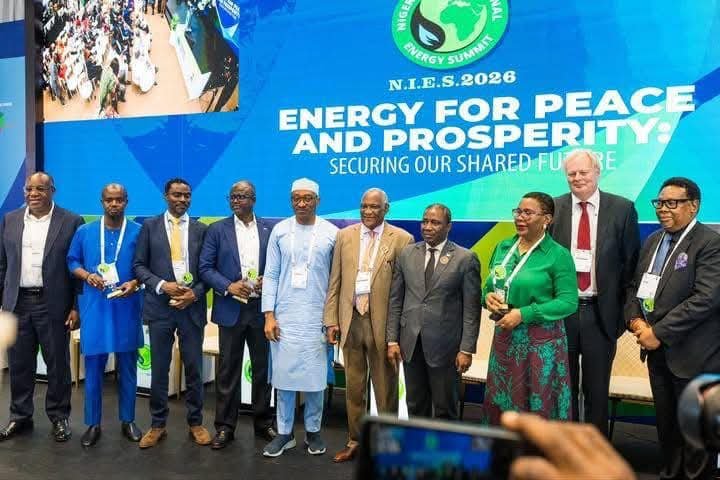

Speaking on a high-level panel at the 2026 Nigeria International Energy Summit (NIES), the Chief Executive of Ghana’s National Petroleum Authority (NPA), Mr. Godwin Edudzi Kudzo Tameklo Esq., framed regulation not as a brake on investment, but as a precondition for it. His intervention—delivered during a session on “Driving Domestic Value: Transforming Downstream Markets and Refining”—placed regulatory credibility at the centre of Africa’s refining and distribution challenge.

The message was unambiguous. Fair pricing, firm oversight, and consistent enforcement, he argued, are not abstract governance ideals. They are the mechanisms through which downstream markets are stabilised, capital is mobilised, and domestic value is protected from leakage.

Why NIES Matters

The Nigeria International Energy Summit has evolved into one of the continent’s most consequential energy convenings, bringing together policymakers, regulators, investors, refiners, and development finance institutions at a moment when Africa’s downstream contradictions are becoming harder to ignore. The continent continues to be an important player in global crude markets, yet continues to export raw barrels while importing refined products at significant fiscal and strategic cost.

Against this backdrop, NIES has become less about aspiration and more about execution—how policy, regulation, and capital can be aligned to convert hydrocarbons into domestic industrial value. It was precisely this execution gap that framed Mr. Tameklo’s contribution.

From Rhetoric to Evidence: What Backs the NPA’s Claims?

Claims of “disciplined regulation” are easy to make and hard to substantiate. What distinguished the NPA CEO’s remarks was that they rested on an increasingly visible enforcement and governance record.

Since January 2025, when Mr. Tameklo assumed leadership, the NPA has pursued a methodical consolidation of regulatory authority in Ghana’s downstream petroleum sector. This has not taken the form of headline-grabbing deregulation or policy reversals, but rather a tightening of institutional control across pricing, licensing, compliance, and safety.

The Authority has intensified enforcement actions against non-compliant operators, deepened collaboration with the judiciary to strengthen sanctions, and worked closely with industry bodies such as the Bulk Oil Distributors and the Chamber of Oil Distributors to reduce malpractice and regulatory arbitrage. At the consumer and community level, the NPA has extended its regulatory reach beyond formal market actors, partnering with traditional leaders—particularly in northern Ghana—to curb fuel theft, dangerous siphoning practices, and spillage-related fatalities.

Crucially, these efforts have been accompanied by institutional modernisation and regional engagement, positioning the NPA not only as a domestic regulator but as a reference point within West Africa’s downstream governance ecosystem. The Authority’s recognition as “Most Connected Energy Sector Agency of the Year” has further reinforced the credibility of its reform narrative.

Taken together, these actions give empirical weight to the CEO’s assertion that disciplined regulation can produce outcomes that serve investors, operators, and consumers simultaneously—an alignment that downstream markets often struggle to achieve.

Regulation and Domestic Value: Connecting the Dots

The relevance of Ghana’s regulatory experience to a panel on domestic value and refining is not incidental. Refining capacity, whether modular or large-scale, is acutely sensitive to pricing distortions, regulatory uncertainty, and enforcement gaps. Where rules are inconsistently applied, refiners face margin volatility, supply insecurity, and heightened political risk—all of which discourage long-term investment.

By contrast, the NPA’s model suggests that regulatory discipline functions as an industrial policy tool. Transparent pricing frameworks reduce arbitrage and smuggling. Predictable licensing regimes lower entry barriers for credible investors. Firm oversight improves product quality and supply integrity. Together, these elements create the conditions under which refining and distribution assets can operate sustainably.

In this sense, Mr. Tameklo’s intervention reframed regulation not as a downstream afterthought, but as a foundational input into domestic value creation—on par with pipelines, depots, and refineries themselves.

Africa’s Downstream Reality Check

Africa’s downstream sector remains fragmented, import-dependent, and, therefore, structurally vulnerable. Despite decades of policy ambition, refining capacity across the continent has lagged consumption growth, leaving governments exposed to global price shocks and foreign exchange pressures. Illicit markets, fuel adulteration, and weak enforcement continue to erode both fiscal revenues and public trust, costing the continent around US$100 billion annually.

Yet the opportunity is equally clear. Rising urbanisation, expanding transport demand, and renewed interest in modular refining and regional supply hubs point to a downstream sector on the cusp of reconfiguration. What remains contested is the governance model that will underpin this transition.

It is here that Ghana’s NPA has sought to project its experience beyond national borders. The Authority’s approach—embedding reform in daily regulatory practice rather than grand policy resets—offers a pragmatic counterpoint to the stop-start reforms that have characterised much of Africa’s downstream history.

A Quiet Assertion of Regulatory Confidence

Mr. Tameklo’s appearance at NIES was not a sales pitch for Ghana, nor an abstract lecture on regulation. It was a quiet assertion that credible institutions matter—that domestic value addition begins with rule-making that is enforced, not merely announced.

As Africa’s downstream debate shifts from whether to refine locally to how to do so sustainably, the NPA’s message resonates beyond Ghana. Discipline, it suggests, may yet prove to be the continent’s most underappreciated downstream asset.