BIDEC Concentration Signals Strategic Vulnerabilities and Investment Opportunities

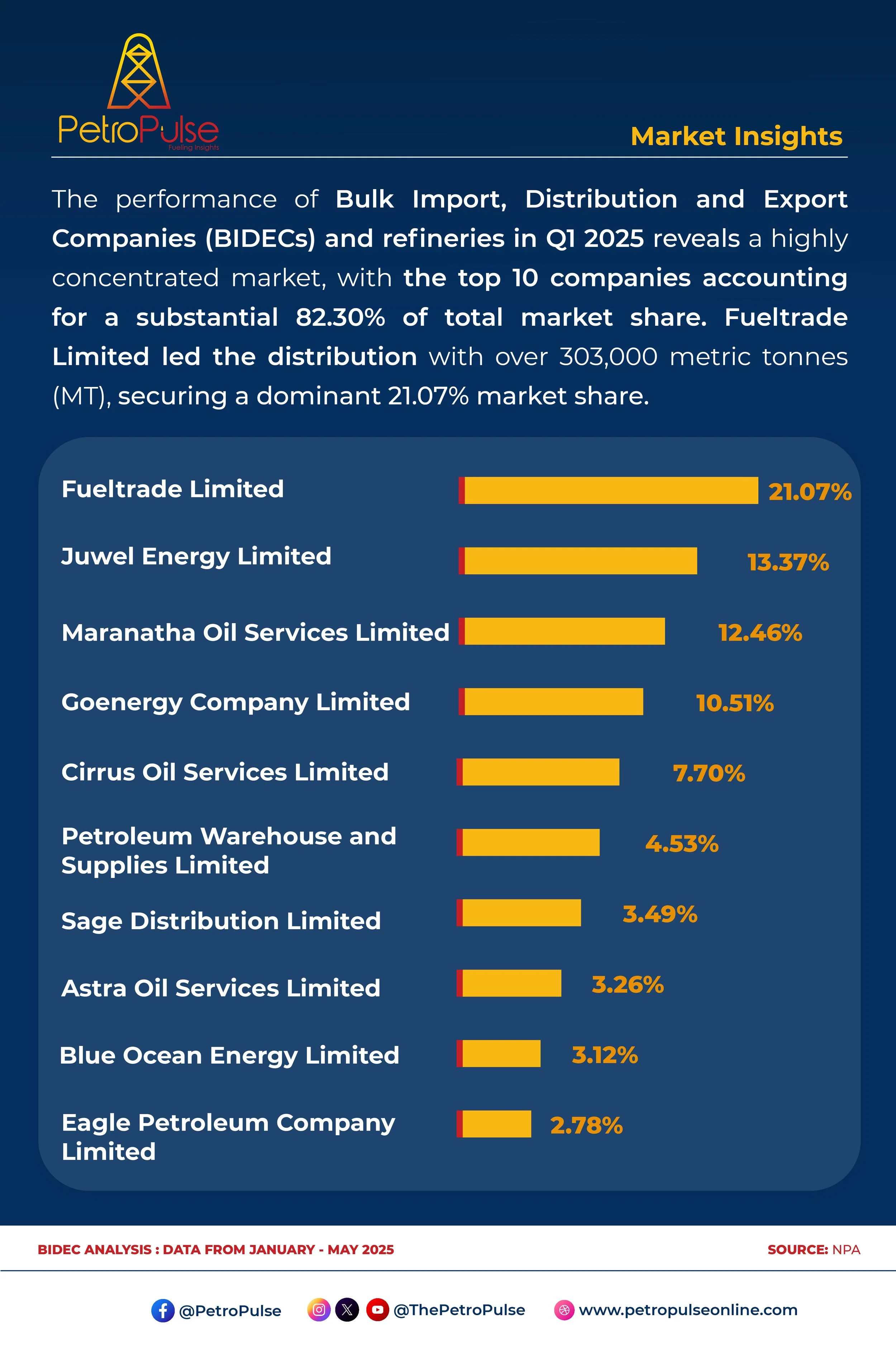

Ghana’s refined fuel import landscape is showing a clear concentration trend, with a few Bulk Import, Distribution and Export Companies (BIDECs) dominating the sector. The National Petroleum Authority’s (NPA) Q1 2025 Petroleum Downstream Performance Report reveals that just ten BIDECs controlled 82.30% of the market in Q1, underscoring their outsized role in national energy security.

Fueltrade Limited led the charge, handling over 303,000 metric tonnes (MT) of imported product to claim 21.07% of total market share. Juwel Energy Limited and Maranatha Oil Services Limited followed closely with 13.37% and 12.46%, respectively. However, beyond the top five, the market saw a steep drop-off—highlighting the widening gap between dominant firms and smaller competitors.

This matters because BIDECs are the linchpin of Ghana’s refined fuel supply chain. Every litre of petrol, diesel, or LPG consumed by households and businesses originates with their import arrangements. They dictate volume availability, interface with global suppliers, and manage the bulk of port-side logistics. A few companies holding the bulk of that responsibility means that the sector’s stability is highly sensitive to the operations, financial strength, and logistics of just a handful of firms.

It also raises deeper questions about resilience and diversification. As Ghana positions itself to take greater control over energy pricing and supply security—especially with the impending restart of Tema Oil Refinery—there is growing need for policy frameworks that encourage competitiveness among BIDECs, bolster transparency in laycan allocations, and incentivize smaller players to scale.

Moreover, with Nigeria’s Dangote Refinery ramping up exports and setting new pricing benchmarks for West Africa, Ghana’s importers may soon need to renegotiate supply models or lose ground to regional competitors.

In a sector where margins are tight and risks high, the NPA’s Q1 2025 data is not merely a scoreboard—it is a strategic roadmap that highlights both consolidation trends and the urgent need for capacity expansion among lower-tier players.