OPEC+ Reaffirms Market Stability Commitments, Announces Modest Oil Output Increase for June

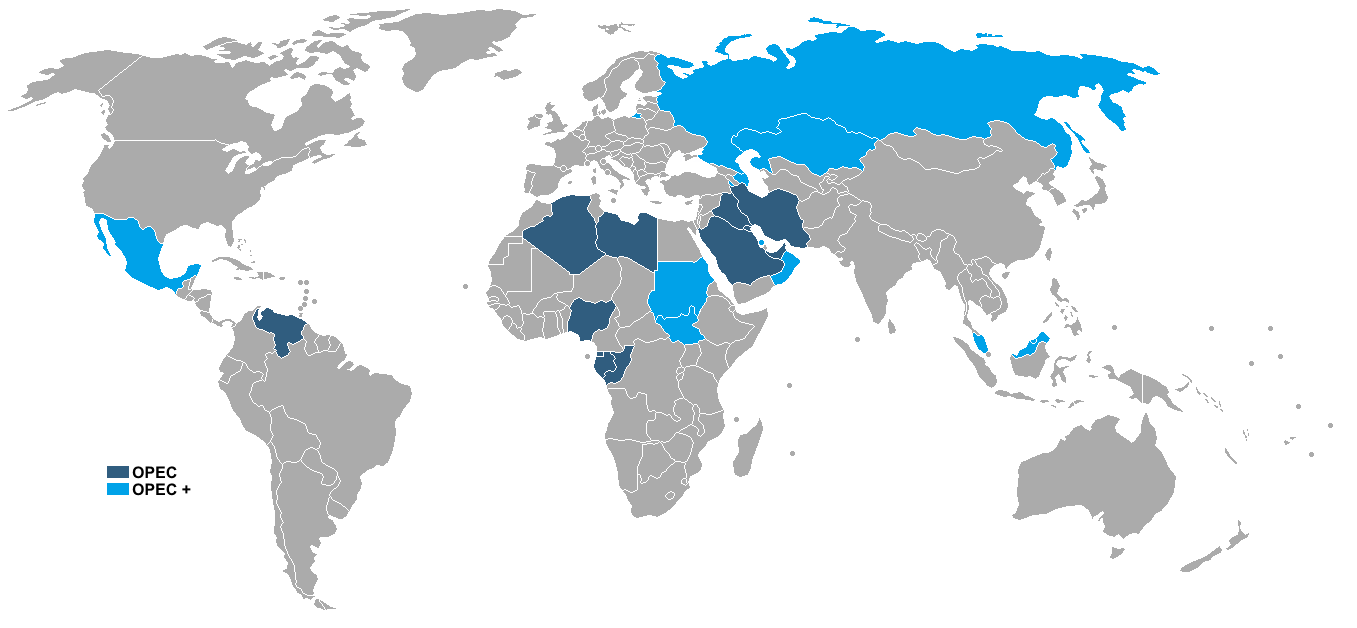

In a closely watched virtual meeting held on May 3, 2025, OPEC+ countries—including major producers such as Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria, and Oman—reaffirmed their commitment to maintaining oil market stability. The discussions focused on assessing current market dynamics amid healthy fundamentals and relatively low global oil inventories.

The coalition, which represents a significant portion of the world’s oil supply, acknowledged that the market continues to benefit from strong underlying conditions. These fundamentals, they noted, are evidenced by persistently low inventory levels—a sign of steady demand and disciplined supply management.

As part of their ongoing strategy to gradually unwind previous voluntary production cuts, OPEC+ agreed to increase oil production by 411,000 barrels per day (bpd) in June 2025. This increment marks a cautious step in the rollback of the 2.2 million bpd in voluntary output reductions that began in April 2025.

However, the group emphasized flexibility in their approach, stating that future adjustments could be paused or even reversed depending on evolving market conditions. This pragmatic stance aims to avoid instability or oversupply shocks that could disrupt the current balance.

In line with their broader strategy, OPEC+ reiterated their dedication to full compliance with the Declaration of Cooperation. The Joint Ministerial Monitoring Committee (JMMC) will continue to oversee adherence to agreed production levels.

To maintain a responsive and adaptive framework, OPEC+ will continue to meet monthly to assess market conditions and make necessary decisions. The next meeting is scheduled for June 1, 2025, during which the group will determine production levels for July.

The latest commitments underscore OPEC+’s strategic focus on supporting global energy market stability, while also providing room to adjust based on real-time market feedback and global economic signals.