PetroPulse Comprehensive Assessment of the Ghana Cedi to U.S. Dollar Exchange Rate in June 2025

Introduction

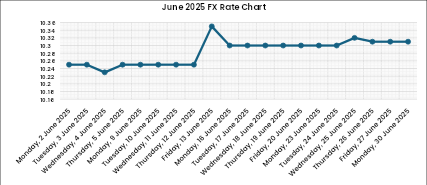

The exchange rate of the Ghanaian cedi (GHS) to the U.S. dollar (USD) is a critical economic indicator, particularly for a country like Ghana that is heavily reliant on foreign exchange for imports—including crude oil and industrial goods, as well as external financing. In June 2025, the GHS/USD exchange rate demonstrated modest fluctuations within a relatively narrow band, indicative of a period of managed currency stability amid broader global financial volatility. This assessment provides a detailed exploration of the GHS/USD exchange rate throughout June 2025, using daily data to highlight key trends and their macroeconomic implications, especially in relation to the energy sector.

Exchange Rate Performance and Trends

The cedi began June 2025 with an exchange rate of 10.25 GHS/USD and remained relatively stable throughout the first half of the month. A temporary appreciation was observed on Wednesday, June 4, when the rate dipped slightly to 10.23, suggesting either a brief increase in dollar supply or a decline in demand—possibly influenced by external inflows or successful FX market interventions.

The rate held steady at 10.25 until June 12, after which it rose marginally to 10.35 on Friday, June 13. This slight depreciation reflects potential seasonal pressures or increased demand for foreign exchange. However, the rate quickly reverted to 10.30 from June 16 to June 24, reflecting an easing of the pressure that had caused the brief depreciation.

A minor uptick was recorded toward the end of the month, with the exchange rate rising incrementally to 10.32 on June 25, then stabilizing at 10.31 from June 26 through June 30. The end-of-month figures indicate some degree of exchange rate management or reduced speculative activity, possibly in anticipation of the Bank of Ghana’s monetary policy statement or mid-year budget review.

Analysis of Market Drivers

Foreign Exchange Demand and Supply: The fluctuations reflect typical patterns of FX demand and supply. The rise around mid-month may correlate with corporate and public sector obligations, including debt servicing, import settlements, or repatriation of profits.

Central Bank Intervention: The relative stability—particularly the quick reversal after June 13—suggests that the Bank of Ghana may have intervened via FX auctions or policy signals to smoothen volatility and maintain market confidence.

Export Receipts and Oil Revenues: The mild appreciation toward month-end could be attributed to dollar inflows from cocoa or crude oil liftings, especially considering the high Brent crude prices during the same period. This would increase Ghana’s FX reserves and ease demand-side pressure.

Speculation and Market Sentiment: The absence of steep or erratic spikes in the exchange rate indicates subdued speculative activity. Investors may have adopted a wait-and-see stance ahead of key economic disclosures or external developments.

Implications for Ghana’s Energy Sector

A stable exchange rate is particularly beneficial for Ghana’s energy sector, where significant costs are denominated in foreign currency. Independent Power Producers (IPPs), bulk oil distributors, and utilities that import fuel or machinery often hedge against exchange rate risk. The relative predictability in June 2025 likely reduced currency conversion losses, minimized fuel price pass-through to consumers, and improved sectoral planning.

Additionally, fiscal projections tied to petroleum revenue were likely shielded from currency shocks, enabling the Ministry of Finance to maintain projected dollar-to-cedi conversion rates for budget implementation. However, the mid-month depreciation spike, though brief, is a reminder of latent volatility risks in Ghana’s FX market that must be monitored continuously.

Conclusion

The Ghana cedi's performance in June 2025 was characterized by mild and controlled fluctuations, ranging from a low of 10.23 to a high of 10.35 GHS/USD. This period of relative stability bodes well for macroeconomic planning and energy sector cost forecasting. While temporary pressures caused minor depreciation, effective market mechanisms or central bank actions appeared to restore equilibrium quickly. Going forward, sustained exchange rate management, supported by foreign inflows and policy credibility, will be essential for mitigating external shocks and ensuring price stability in vital sectors such as energy.