OMCs and the Fight for Market Share in a Competitive Retail Fuel Arena

Oil Marketing Companies (OMCs) form the most visible—and arguably most scrutinized—layer of Ghana’s petroleum value chain. They are the face of the industry to the everyday consumer, and their market performance directly influences pricing, fuel quality, and customer experience across the country.

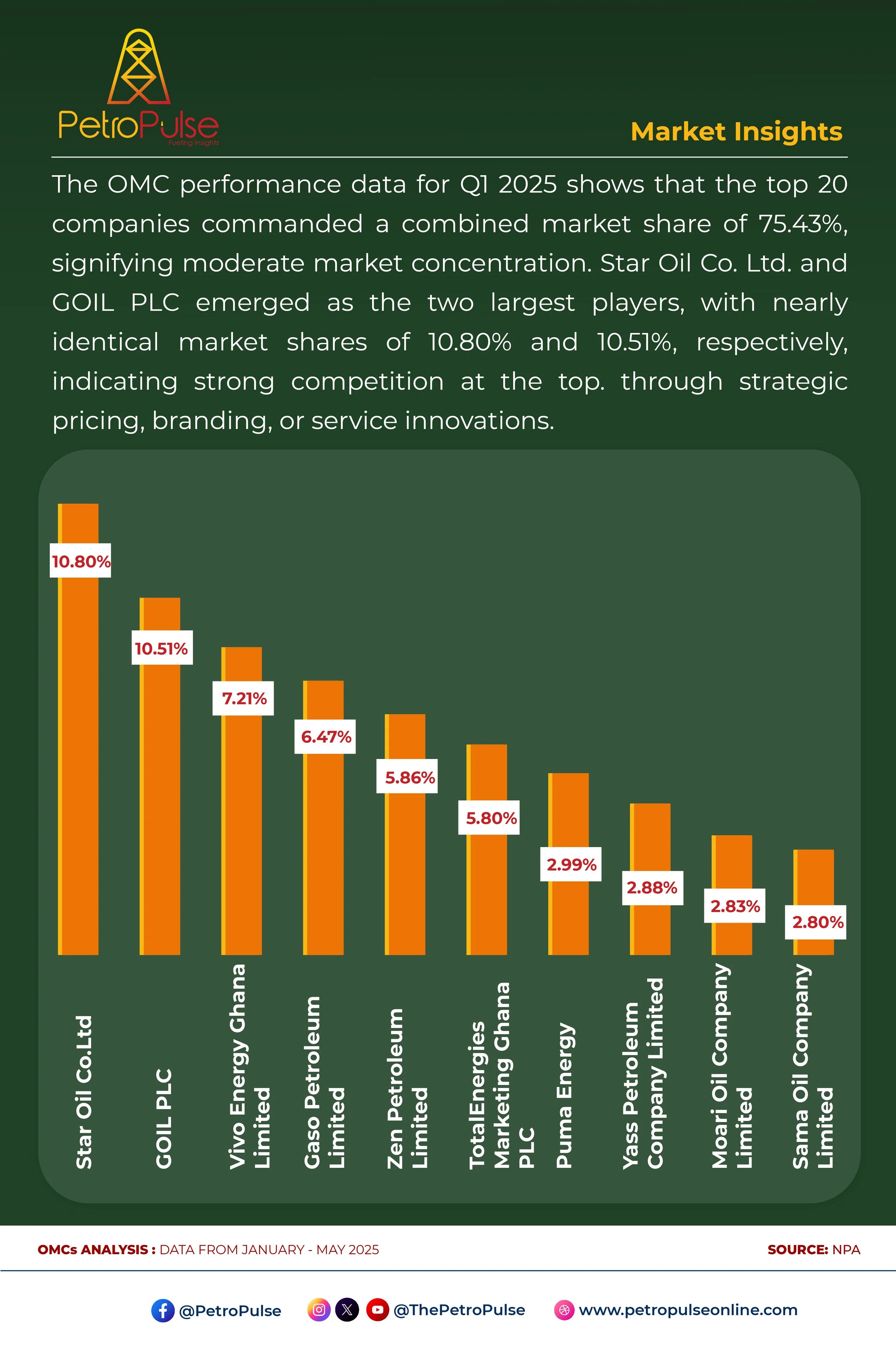

According to the Q1 2025 Petroleum Downstream Performance Report by the National Petroleum Authority (NPA), the top 20 OMCs commanded 75.43% of the market. Star Oil Co. Ltd. edged out competitors with 10.80%, while GOIL PLC, Ghana’s partially state-owned fuel giant, followed closely at 10.51%. Vivo Energy Ghana and Gaso Petroleum also made strong showings, with other players in the top ten holding between 2.8% and 7.2% market share.

This diversity at the top indicates a healthy level of competition—but also an ongoing contest for differentiation. For many Ghanaians, OMCs are not just fuel providers; they’re employers, service innovators, and increasingly, ESG actors. They determine whether fuel is available, affordable, and clean.

These performance rankings matter because they highlight sector resilience and consumer trust. Companies like Star Oil and GOIL have built reputations for network expansion and pricing consistency—traits that are becoming even more vital as fuel consumption patterns shift due to urbanization and economic fluctuations.

What’s also notable is that OMC performance ties directly into the deregulation policy landscape, which COMAC and the NPA continue to refine. Understanding which firms are thriving under this model—and why—can help shape smarter margin regimes, improve tax compliance, and ultimately enhance service delivery.

In the context of Ghana’s larger energy ambitions, strong OMCs serve as pillars of national distribution efficiency. Their ability to store, distribute, and market refined fuels sustainably is what keeps the economy running—from taxis in Takoradi to agro-processing plants in Tamale.

The NPA’s Q1 report, therefore, does more than offer rankings—it frames the evolving identity of retail petroleum in Ghana, and hints at who may dominate the next phase of sector innovation.